Which legal entity is best for your capital raise? Discover how LLCs and LPs differ and which is the better fit for your PPM and investor structure.

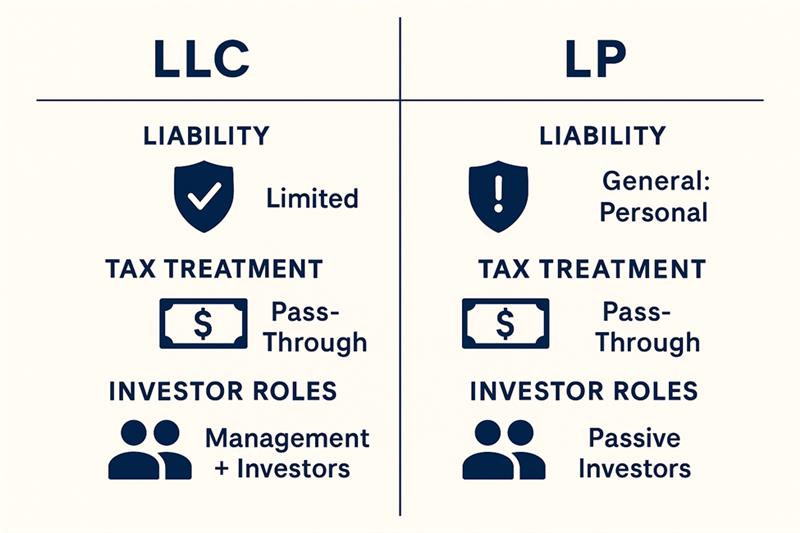

Raising capital legally means more than filing paperwork with the SEC. The legal entity you choose for your investment offering—whether it’s a Limited Liability Company (LLC) or a Limited Partnership (LP)—has a major impact on how you structure your deal, protect your interests, and build investor trust. Choosing the wrong entity can create unnecessary liability, tax inefficiencies, or deal-killing investor concerns.

In this post, we’ll walk you through the pros and cons of LLCs and LPs in the context of a Private Placement Memorandum (PPM), so you can confidently structure your next raise.

What Is An LLC And Why Real Estate Syndicators Love It

A Limited Liability Company (LLC) is a flexible legal structure that combines the liability protection of a corporation with the pass-through taxation of a partnership. In a capital raising context, especially in real estate, LLCs are often used as the investment entity that holds the project and brings in investor capital.

Advantages of using an LLC for your PPM:

- Flexible Management Structure: LLCs can be member-managed or manager-managed, allowing syndicators to retain control while giving investors limited decision-making power.

- Pass-Through Taxation: Income is passed through to members, avoiding double taxation and simplifying tax reporting.

- Simplified Compliance: LLCs generally have fewer formalities and administrative burdens compared to LPs.

- Investor-Friendly: Familiarity and comfort—many investors are already accustomed to investing in LLCs.

Drawbacks of an LLC:

- Self-Employment Tax Exposure: If not properly structured, members may be subject to self-employment taxes.

- Varying State Laws: LLC statutes differ by state, which may affect consistency across multi-state investments.

LLCs are often a go-to for real estate syndicators because they make management and investor roles clear in the Operating Agreement, which is referenced and summarized in the PPM.

What Is An LP And Why Some Fund Managers Prefer It

A Limited Partnership (LP) is a business structure with at least one General Partner (GP) who manages the business and bears full liability, and one or more Limited Partners who contribute capital and have limited liability.

Advantages of using an LP for your PPM:

- Clear Role Separation: LPs have no management authority, which can provide comfort to regulators and investors that the deal is manager-controlled.

- Tax Planning Flexibility: LPs can sometimes offer more refined tax allocations depending on the structure.

- Professional Appearance: Institutional investors often view LPs as more formal and familiar structures for private equity-style funds.

Drawbacks of an LP:

- GP Liability: The General Partner may bear liability unless insulated through an LLC or other legal structure.

- More Formalities: LPs may require annual meetings, specific filings, and other formalities.

- Perceived Complexity: Less familiar to newer investors, LPs may require more explanation in your PPM.

Many larger private equity funds and venture capital funds use LPs, often with an LLC acting as the General Partner to manage risk.

Entity Choice Impacts Your PPM Structure

Your choice of entity shapes not just your internal governance, but also how your Private Placement Memorandum is written and understood by investors. Key areas impacted include:

- Disclosure Language: LPs and LLCs have different liability and control structures that must be clearly explained in the PPM.

- Governance Terms: Voting rights, capital calls, profit allocations, and exit strategies must align with the chosen entity.

- Investor Rights and Limitations: LPs may require stronger language on passive participation; LLCs allow for more nuance.

A securities attorney will tailor your PPM to reflect the entity type, ensuring that it accurately discloses risks, roles, and responsibilities.

How To Decide: LLC Vs LP For Your Raise

When deciding between an LLC and LP for your investment offering, consider the following:

- Who will be managing the investment? If you want centralized control, both entities allow it, but LPs may signal a more formalized separation to institutional investors.

- Who are your investors? High-net-worth or institutional investors may be more comfortable with an LP, while retail or less experienced investors often prefer LLCs.

- What are your liability concerns? LLCs provide broad liability protection for all members; LPs may expose the GP unless another structure is layered in.

- How complex is your capital stack? LPs might offer better tools for multi-tiered profit sharing and waterfall structures.

Consult with your legal advisor to weigh these factors in light of your specific project and investor base.

Hybrid Structures: The Best Of Both Worlds?

Some sponsors choose to create an LP with an LLC serving as the General Partner. This hybrid approach can:

- Shield the GP from personal liability

- Provide the professional appearance of an LP

- Maintain flexible management through the LLC structure

However, hybrid structures can increase legal and accounting complexity, so make sure you’re working with experienced legal counsel.

Final Thoughts: Don’t Let Entity Choice Undermine Your Raise

Your investors want clarity, professionalism, and legal protection. The entity you choose affects all three. Whether you choose an LLC, LP, or some other structure, your PPM must clearly disclose the structure, risks, and management roles. A properly tailored legal framework builds trust and sets the stage for a successful, compliant raise.

Book a Free Strategy Call to Get Your Legal Docs in Place and make sure your PPM and entity structure are aligned with your capital raising goals.