Start preparing your 2026 capital raise today with these legal and strategic steps to stay ahead of the game. Ready To Raise Capital In 2026? Start Now Or Risk Falling Behind If you’re thinking about raising capital in 2026 for a real estate syndication/fund, investment fund, or startup, you need to start laying the legal Read More

Category: Blog

Investor Pitch Decks And The Law: What Needs To Be In Writing

Learn what legal essentials must go into your investor pitch deck to stay compliant and raise capital confidently. When you’re raising capital, whether for a startup, real estate syndication, or a fund, your pitch deck may be the first impression you make. But here’s the legal reality: everything you say (or fail to say) in Read More

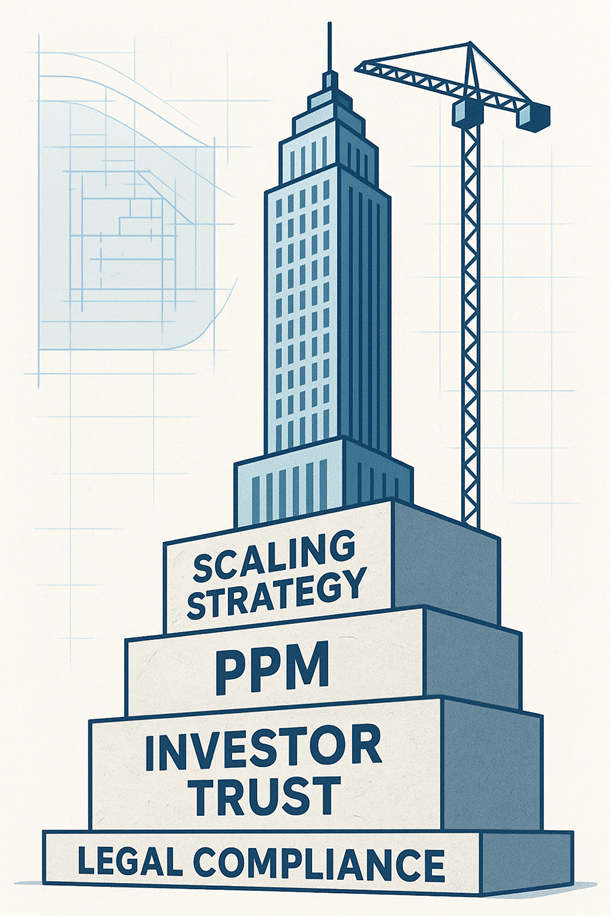

How To Scale Your Capital Raising With A Legally Sound Foundation

Want to scale your capital raise? Start with a rock-solid legal strategy to stay compliant and build investor trust. Scaling your capital raising efforts is an exciting milestone for any business, syndication, or fund. But with growth comes complexity, and the last thing you want is for that complexity to become a legal liability. Whether Read More

Accepting Foreign Investors? Here’s What You Need To Know

Thinking about accepting foreign investors? Here are the legal basics you must understand before crossing borders with your capital raise. Raising capital is hard enough within U.S. borders. Add in foreign investors, and the legal stakes get even higher. Whether you’re a real estate syndicator, fund manager, or startup founder, accepting capital from outside the Read More

Avoiding Investor Lawsuits: How A PPM Protects You

Discover how a well-drafted PPM shields you from investor disputes and keeps your capital raise legally compliant. Raising capital is mission-critical but it does carry risky. One of the biggest risks? The potential to be sued by your own investors. While you might think this only happens in big scandals or fraud cases, the truth Read More

What Investors Expect To See In A PPM

Understanding what your private placement memorandum (PPM) must include to build trust and legally raise capital. Raising capital legally starts with trust—and trust begins with transparency. For sponsors, fund managers, and founders navigating the private markets, a well-drafted Private Placement Memorandum (PPM) is the cornerstone of a compliant and compelling investor offer. But what exactly Read More

Why Hiring A PPM Lawyer Before Approaching Investors Is The Smartest Move

When founders, fund managers, and entrepreneurs begin planning a capital raise, their instinct is often to line up investors first and then deal with the legal and compliance documents later. On the surface, this seems cost-effective—you save money upfront and only spend on lawyers once an investor is serious. But here’s the reality: this approach Read More

Online Fundraising & Crowdfunding: How To Stay SEC Compliant

Learn the legal rules for online fundraising and crowdfunding under Reg D to avoid SEC violations when raising capital digitally. Raising capital online has never been easier, but there is risk involved that is critical to understand. Platforms, social media, and email marketing have opened doors for startups, real estate syndicators, and investment funds to Read More

Redlining A PPM: What Lawyers And Investors Look For Before Signing

Discover what investors and lawyers scrutinize when redlining a PPM—and how to get yours right to raise capital legally. When you’re preparing to raise capital using a Private Placement Memorandum (PPM), there’s a critical step that can make or break your deal: redlining. This process—where lawyers, investors, and sometimes co-GPs comb through the document—is more Read More

How To Build A Compliant Investor List Without Breaking SEC Rules

Learn how to legally grow your investor list without triggering SEC violations. Smart strategies for Reg D marketing and investor compliance. When it comes to raising capital, who you market to matters just as much as how you do it. For real estate syndicators, fund managers, and startup founders, building a high-quality, compliant investor list Read More